If you experience heartburn at just the thought of an audit, you are not alone. An audit can provide meaningful information about the financial performance of your organization.

Unfortunately, it can also shine a light on what may be an ongoing problem in your business: an inadequate financial accounting system.

If you are facing long hours in order to pull together the Audit Request List (often called the PBC List), the list of schedules and spreadsheets that your auditing firm will expect you to provide, then your financial accounting software could be failing you.

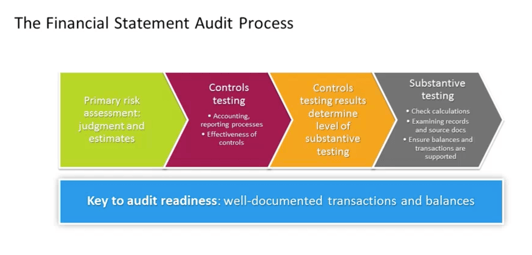

The key to audit readiness: well-documented transactions and balances

The key to audit readiness is simple but not easy, especially if you do not have the right tools to begin with. You may have outgrown the entry level accounting software that served you well for many years. If you are operating on a legacy system designed several decades ago, the system architecture was not designed to address the rigors of 21st century business.

To make up for the limitations of the software, you have probably turned to spreadsheets. One of the many problems with spreadsheets is that they do not provide optimal levels of traceability and data details, nor do they demonstrate confidence around transaction detail and controls.

The three most common audit pitfalls

The aspects of audits for most businesses, with the most risk, are centered on Revenue Recognition, Receivables, and Consolidations.

This webinar is available for you to watch at your convenience by clicking here. You will learn that 20% of the audience ranked receivables the most challenging aspect of their audits, while the remaining 80% was evenly split between revenue recognition and consolidations.

Modern financial accounting software solutions

In addition to being able to quickly generate the reports for the Audit Request List, we recommend Sage Intacct financial accounting solution for its ability to automate many of your accounting processes, while at the same time consistently adhering to internal controls.

Sage Intacct was designed to address and simplify the challenges encountered in the areas of receivables, consolidations, and revenue recognition. In the area of receivables, just the simple adjustment of getting invoices out a day or two faster can have a noticeable effect on cash flow and the bottom line. When it comes to consolidations, Sage Intacct was designed to handle multiple entities as well as multi-currency. The third area which further propels Sage Intacct beyond the competition, is its ability to handle revenue recognition in full compliance with ASC 606 FASB requirements.

Cordia Partners is your go-to accounting resource

There are many ways Cordia Partners can help you transform your financial accounting function and do so in a manner that brings impactful ROI. Please contact us for a free consultation to discuss your business needs (in addition to viewing ‘Audit-Ready Financials – Best Practices to Avoid Common Pitfalls’).

We are ready to help you implement the changes that will best position you to reach and exceed business goals.

© 2018